PayU India launched a first product of its own kind in India for any individual or a business to go online and start collecting payments online in a few minutes of sign up. This product is free for the seller, and it gives you some tools like a free web store, free storefront and email invoicing. In India, PayU India is the fastest growing online payment company. It has a strong dispute resolution center to safeguard buyers and keep their money safe even when they have paid for a product or service. But some question surely rises.

Why a seller need to build his own web store online?

By doing this you can increase sells of your goods, painting, handicraft etc. And today where everyone work on this theory ” Search First, Then Buy”. So if some one will find you on internet and he finds you trusty then surely he will wants to buy from you. And here PayU India is offering you web store and emails invoicing totally free. On the other hand a seller don’t need to follow any lengthy process for sign up, everything is online here. A seller needs to do is just punch in the PAN card number, bank account details, and the verification process is over!

How PayUPaisa will help you to increase the selling of your goods?

Well, PayU has a unique and patented algorithms system that tracks down customers and sends them to seller website. When a transaction failed a normal payment system don’t allow you to go back for transactions. But PayU allows you to even refresh your browser page so that you can easily pay money.

Why Buyers will use PayUPaisa?

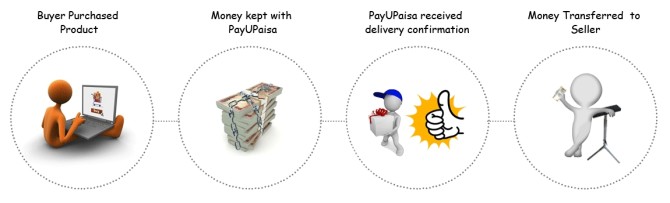

Because PayUPaisa safeguard buyer’s money and protect him through its strong dispute resolution process. PayUPaisa has various safety checkpoints to make online buying totally safe. When a buyer bought something, PayUPaisa keeps that money to itself until it receives confirmation of delivery then the money is transferred to seller.

“For a country like ours which has a population of over 1.2 billion out of which more than 300 Million have a bank account, and an internet penetration which exceeds 150 million; only fewer than 7 million people actively buying online is a minuscule number. What is even more disappointing is that with over 30 Million SMEs and around 5 Million freelancers in India, fewer than 10,000 people sell online today. PayUPaisa was born out of these needs and intends to solve the above problems. Our objective is to enable 1 million sellers and 20 million buyers on PayUPaisa platform in the next 3. We will redefine the way payments will happen in this country and believe PayUPaisa is a market disrupting payment solution.” quoted Nitin Gupta, Co-founder and CEO at PayU India.

For the latest technology news and reviews, like us on Facebook or follow us on Twitter.